Cambridge Growth Partners is dedicated to creating long-term value for its investors and stakeholders. The company seeks out innovative ventures and opportunities that have the potential for significant growth, profitability, and sustainable returns. By identifying high-potential ventures and deploying capital effectively, Cambridge Growth Partners aims to generate superior value for its portfolio companies and investors.

Strategy

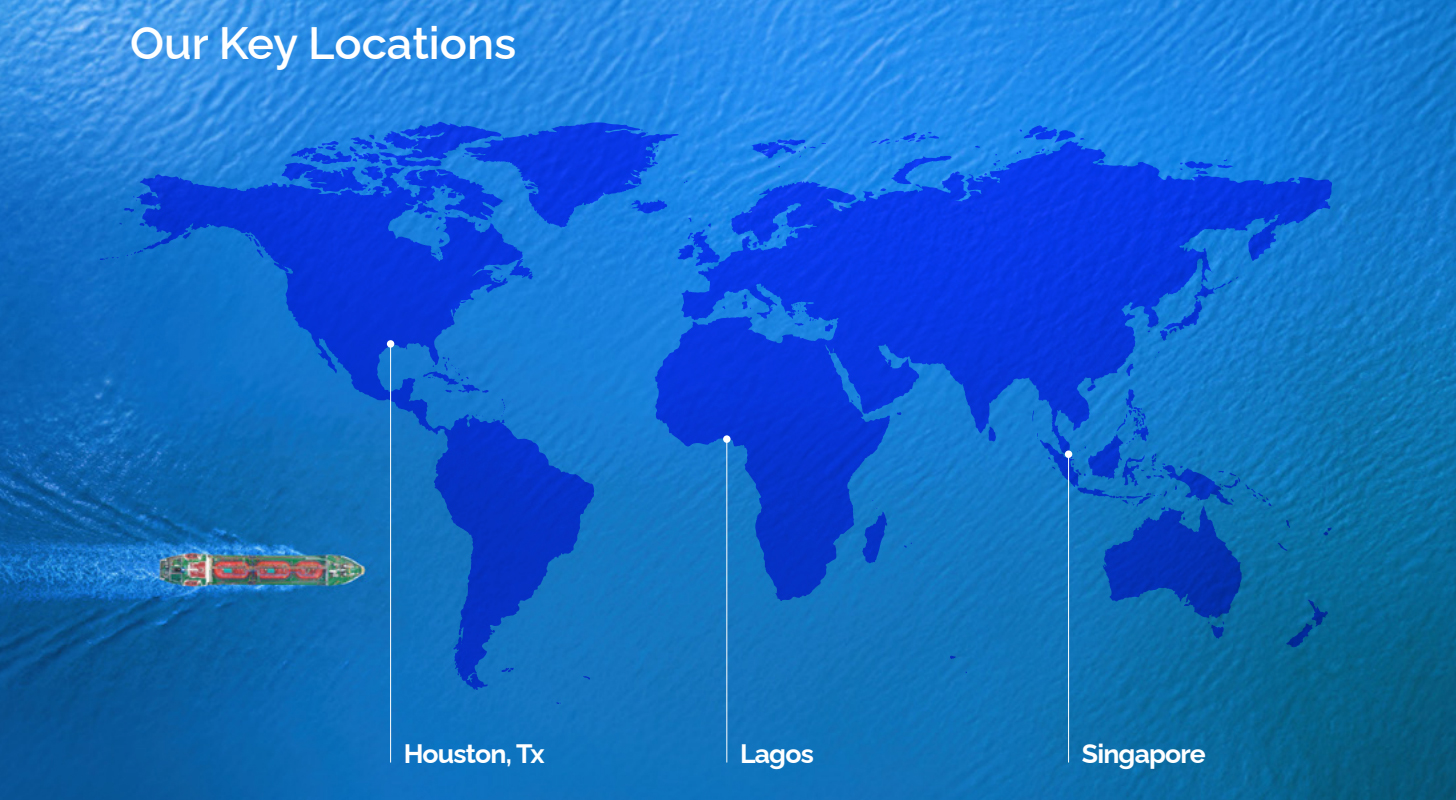

Through its diverse portfolio and strategic investments, the firm continues to make a significant impact in various industries, positioning itself as a leading investment company at the forefront of innovation and growth. We have a strong foothold in key growth regions, allowing us to access emerging markets and forge strategic partnerships. Our global reach, combined with an experienced team of professionals, positions the company as a trusted and influential player in the investment landscape. Cambridge Growth Partners positions itself to identify, invest in, and actively support high-potential ventures, generating sustainable growth, value creation, and superior returns for its investors. With a strategic focus on long-term success, we actively seek opportunities to support and partner with high-potential companies. The strategy of Cambridge Growth Partners is driven by several key factors:

Value Creation

Sector Expertise

The firm leverages its deep industry knowledge and expertise across various sectors to drive its investment strategy. Cambridge Growth Partners focuses on sectors with compelling growth prospects, emerging technologies, and disruptive trends. By understanding market dynamics, industry trends, and competitive landscapes, the company positions itself to capitalize on opportunities and make informed investment decisions.

Active Partnership

Cambridge Growth Partners adopts an active partnership approach with its portfolio companies. Beyond providing financial capital, the firm actively supports its invested ventures through strategic guidance, operational expertise, and access to its network of industry connections. By actively engaging with portfolio companies, we aim to accelerate growth, optimize operations, and enhance the overall value proposition.

Rigorous Risk Management

Effective risk management is a fundamental aspect of Cambridge Growth Partners’ strategy. The firm employs thorough due diligence processes, risk assessment frameworks, and proactive monitoring to mitigate potential risks. By managing risks diligently and continuously monitoring investments, Cambridge Growth Partners strives to protect capital and optimize risk-adjusted returns.

Global Perspective

The firm’s global perspective plays a crucial role in its investment strategy. The company recognizes the importance of diversification and the potential of emerging markets. By maintaining offices in Nigeria and Singapore, the company gains insights into regional opportunities, establishes local networks, and expands its reach into promising markets. This global outlook enables the firm to identify attractive investment prospects and drive growth on a broader scale.

Impactful Investing

Cambridge Growth Partners integrates sustainability and impact considerations into its investment strategy. The company recognizes the significance of environmental, social, and governance (ESG) factors and seeks investments that align with sustainable development goals. By supporting ventures that prioritize responsible practices and have a positive societal or environmental impact, we aim to drive both financial returns and broader positive outcomes.